The StartEngine Index: September 2017

The following data covers Regulation Crowdfunding raises between May 16, 2016, and September 30, 2017. Data is sourced from all publicly disclosed Form C filings with the SEC, as well as public websites.

New(!) Analysis

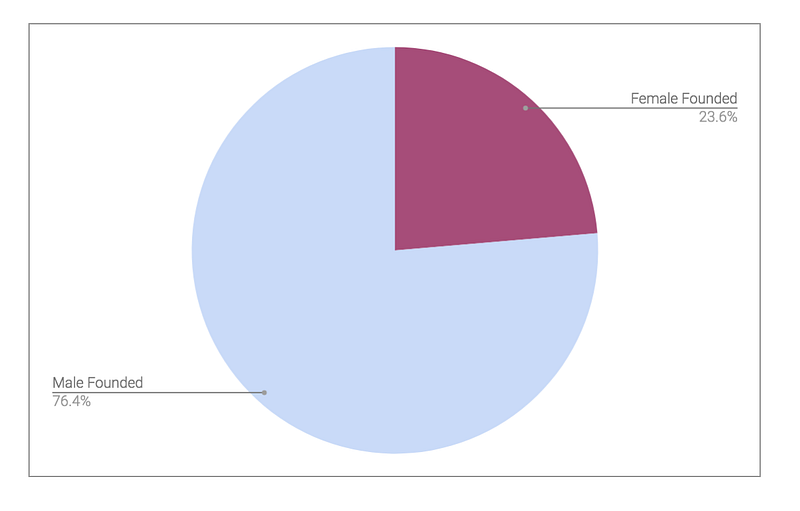

Gender of Founders

This month, we analyzed the gender of the founders and founding teams of companies that raised via Regulation Crowdfunding.

We are proud to report that over 23% of funding dollars went to female founders or co-founders. On the contrary, in 2016, it’s reported that only 4% of VC funding went to women.

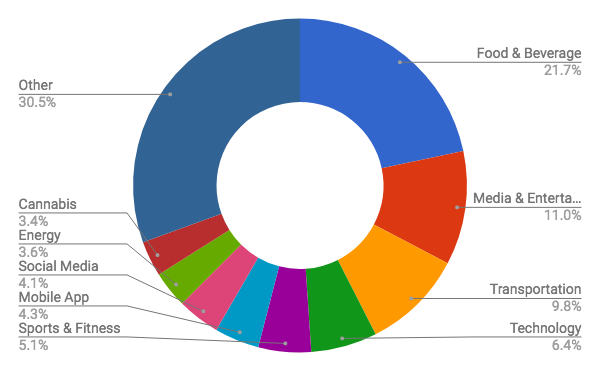

Industries

This month we also began tracking the industries from which companies are raising the most capital. The first report will rank the top industries in Regulation Crowdfunding since inception.

In first place is the Food & Beverage industry at 21%. This includes breweries, wineries and distilleries. Second, at 11%, is the Media & Entertainment Industry, which includes movies, games, shows and media platforms. In third place is Transportation at 10% which includes electric cars, electric bicycles, and transportation technologies.

Standard Analysis

Index: 676

The index increased by 64 points for a total 676. This is a 10% increase over August. Read up on last month’s index here.

Total Capital Raised

Across all platforms, companies have raised nearly $67M through Reg CF.In September, over $6.4M was raised nationally.

Type of Company

The legal formation of the companies who raises capital has remained constant with 69% being corporations and 30% limited liability corporations.

Type of Securities Offered

Common shares are still the most popular offering, however its share has decreased to 31% from 35% in the previous month. SAFE which the second most popular security at 23%.

Average Company Makeup

The average company is 6 employees, a small increase from last month which was 5, and the average company has been in business for 3 years. The average assets are $389K, up from last month $372K, average amount of cash is 77K, and average revenue is $353K. No real change from last month. The average company is not profitable, with an average $229K in losses for the prior fiscal year.

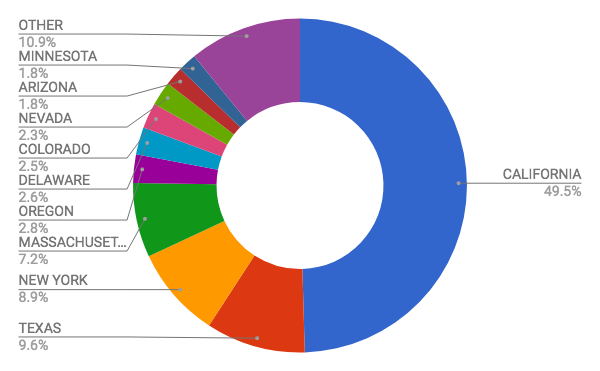

State of Operation

This month we are going to look at the total amount raise by each State for the month of September. California continues to impose its dominance with 50% of the market. This number has grown in the last 15 months from 34.7%. Second in line is now Texas, which jumped from fourth place to second place at 10%.

New York has dropped to third at 9%, but is taking up a larger share than its previous 4%.

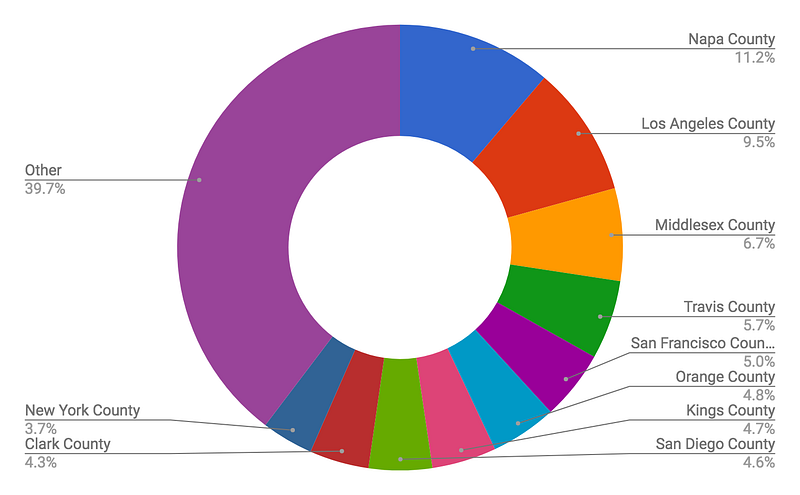

County of Operation

This month, we looked at how counties faired only in September, instead of looking at the raises since the inception of Regulation Crowdfunding.

This month, Napa County had the most dollars raised with 11% followed closely by Los Angeles County 10%. So what is going on in Napa County? Turns out the Napa Valley Distillery raised $757,000, which was the most money raised in September.

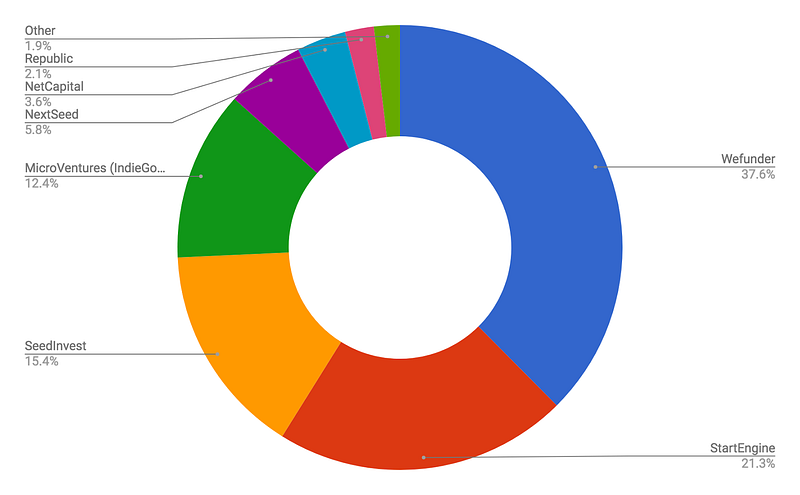

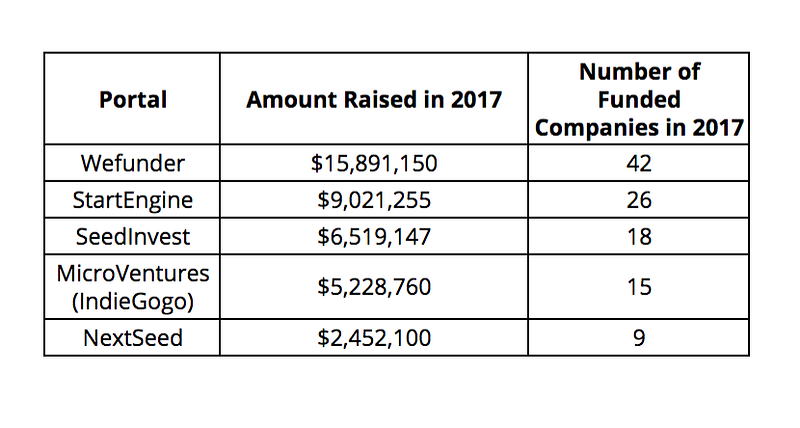

Funding Portals in 2017

Since the beginning of the year, the funding portals with the most closed funding raised under Regulation Crowdfunding continues to be Wefunder with a market share of 38%, down 7 points from last month followed by StartEngine with 21%, slightly down.

SeedInvest is now in the third spot to third spot with 15% a small decrease from last month’s 18%.

Raising in Los Angeles

In September, greater California and the greater U.S. continued to see growth in Regulation Crowdfunding numbers. However, Los Angeles Country saw less capital raised this month than it did last month, indicating a broader spread of capital across the country.

Los Angeles County by the Numbers

17

campaigns in progress. This is the same number as last month, which means the same number of campaigns closed as opened (4).

4

new campaigns submitted to the SEC in September.

4

successful closes in September.

~$631K

raised in September.

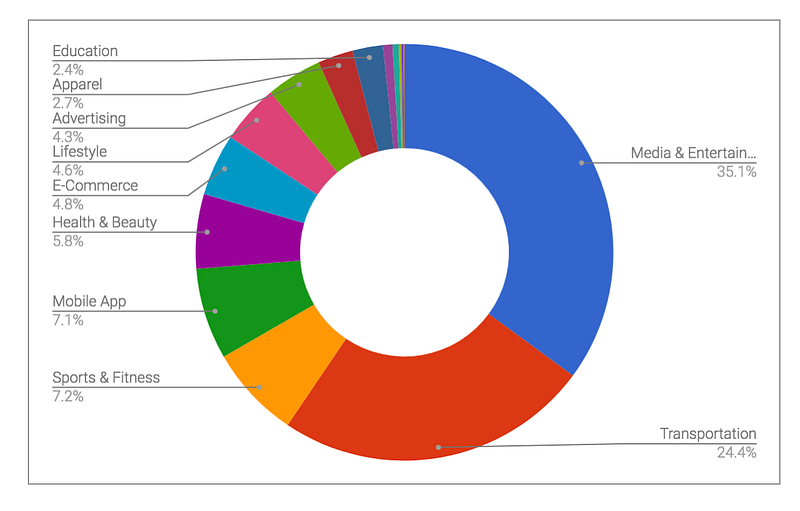

Industries of LA Raises

Unsurprisingly, Hollywood reigns supreme. Media & Entertainment accounts for 35.1% of the Regulation Crowdfunding raises, followed by Transportation (24.4%).

Gender of LA Founders

The gender gap is at par with the rest of the country. In LA, 22% of funded dollars have gone to female founded companies.

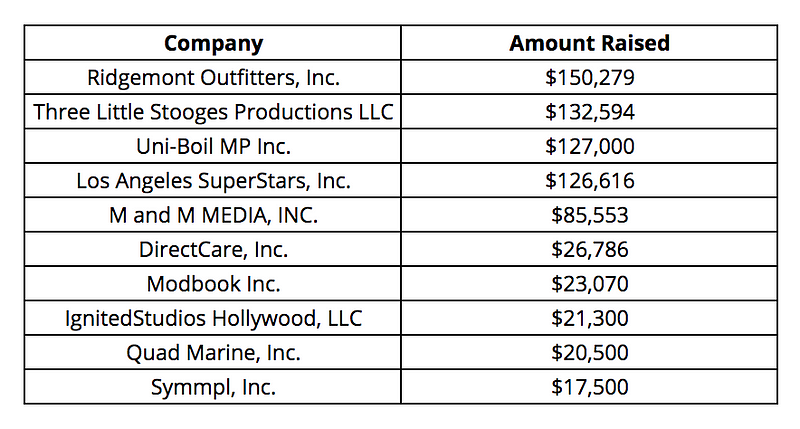

Los Angeles Top 10 Live Raises

In the spirit of our national analysis, we took a look at the Top 10 LA-Based raises that were live in September.

Cheers to all the entrepreneurs who are jockeying for position!