The StartEngine Index: August 2017

The following data covers Regulation Crowdfunding raises between May 16, 2016, and August 31, 2017. Data is sourced from all publicly disclosed Form C filings with the SEC.

Index: 612

The index has increased by 17.7%. Since August 2016, the compounded annual growth is now at 27.7%, showing accelerated growth in the recent months.

Wowza.

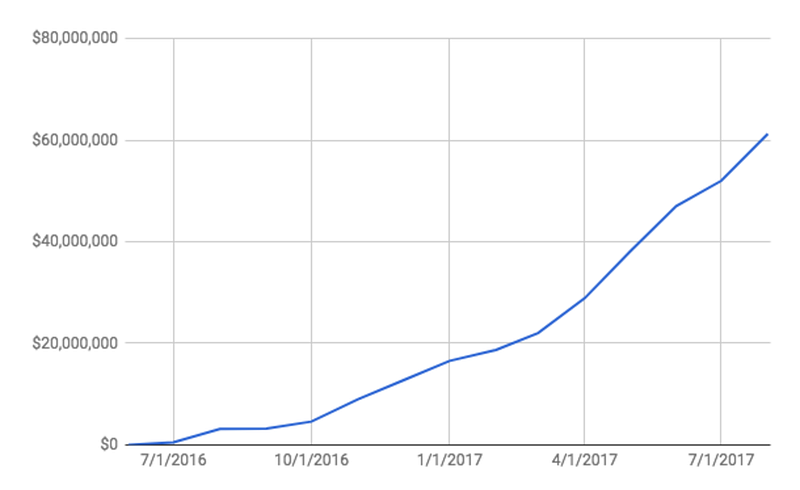

Total Capital Raised

Across all platforms, companies have raised nearly $61M through Reg CF.

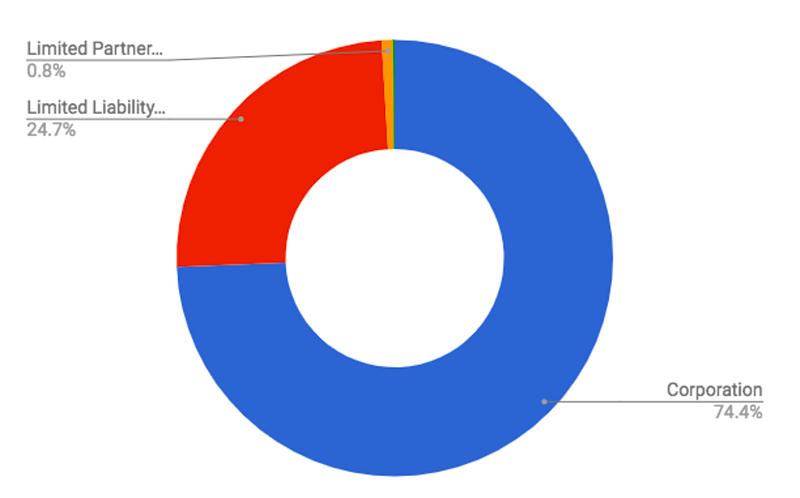

Type of Company

More corp.

Most companies raising through Reg CF are corporations with 74.4%. The rest are, for the most part, LLCs. The share toward corporations has slightly increased from 68.4% in July 2017.

Type of Securities Offered

Common shares outrun SAFEs.

Common shares are still the most popular security offered at 35.5%, which is a sharp increase from last month which was 28.5%.

SAFE securities decreased this month, although they’re still in second place at 24.1%. Last month they were at 28.2%. This is probably due to the SEC’s warning about the complexity and issues with SAFE securities.

Average Company Makeup

If it looks like a startup, and acts like a startup…

The average company is still at 5 employees and is 3 years old. The average assets are $372K, down from last month $400K, under $70K is cash, and average revenue is $282K.

The average company is not profitable, with an average $220K in losses for the prior fiscal year.

The startup makeup trend is reasonably stable showing Regulation Crowdfunding attracting early stage companies in need of capital to grow.

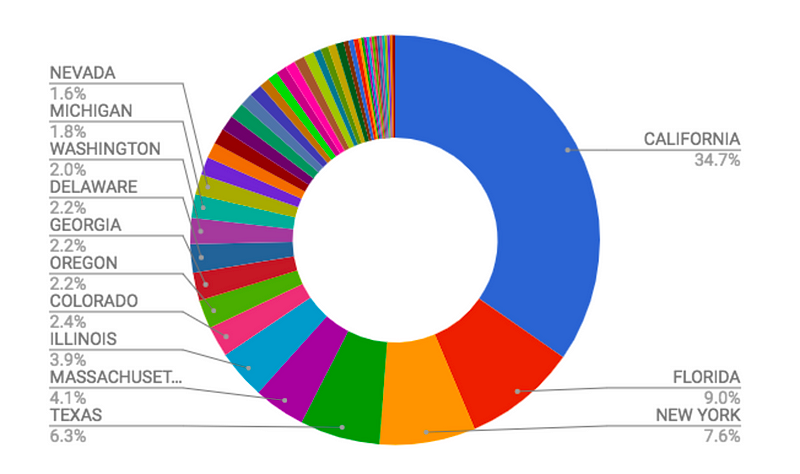

State of Operation

Here comes Florida.

California remains the dominant state of operations for 34.7% of the companies, down from 40% last month. Second is now Florida, which jumped from fourth place to second place at 9%.

Third is New York at 7.6%, a slight increase from the previous month.

County of Operation

Austin proves its startup scene.

This month, it is the County of Travis, Texas that takes the first spot with some very impressive raises totaling $5.9M with 9.6% share since the inception of this index. Travis got a $1.07M boost this month from one raise, Gab, a censor-free social media network.

This is closely followed by Los Angeles county with $5.6M in raises representing 9.1%.

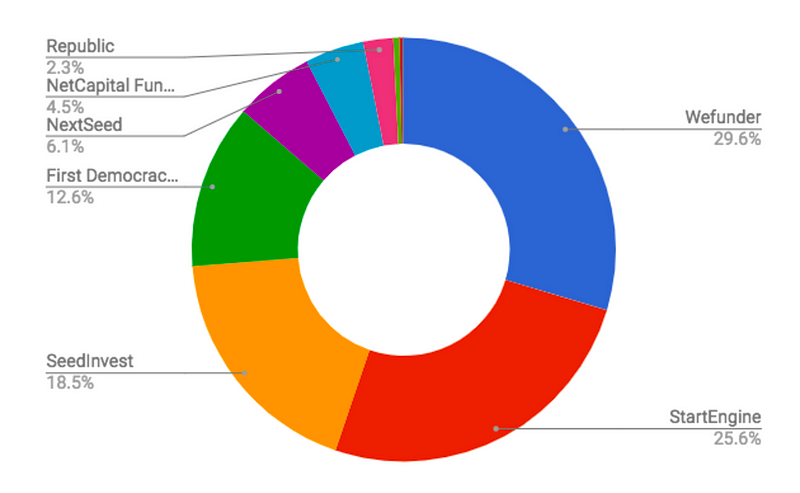

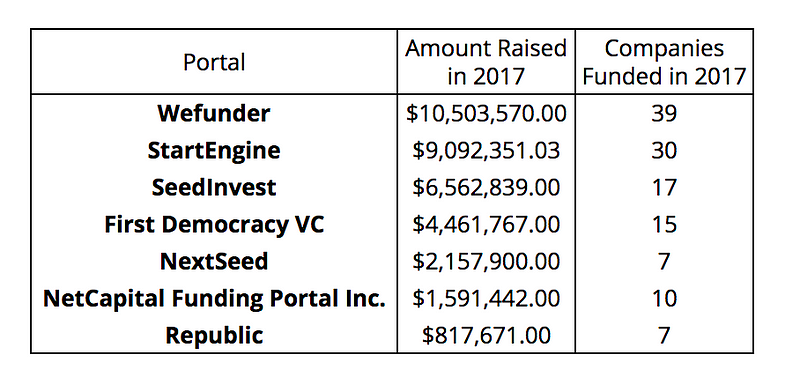

Funding Portals in 2017

StartEngine and Wefunder are neck and neck.

Since the beginning of the year, the funding portals with the most closed funding raised under Regulation Crowdfunding have been Wefunder with a market share of 29.6%, down 5 points from last month followed by StartEngine with 25.6%, slight down as well.

SeedInvest jumped from fourth spot to third spot with 18.5% a sharp increase from last month’s 12%.

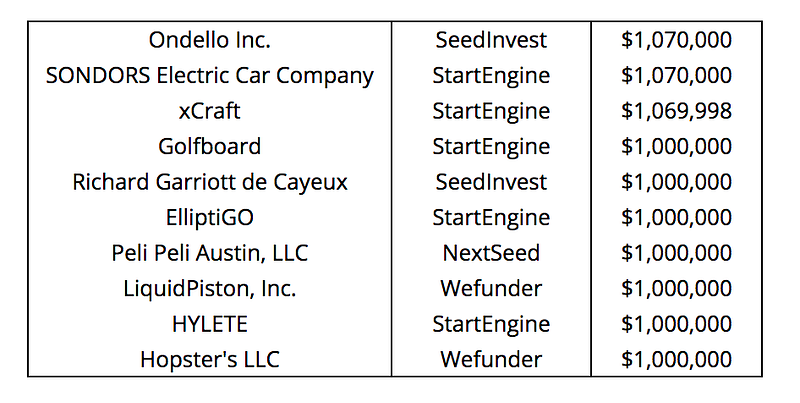

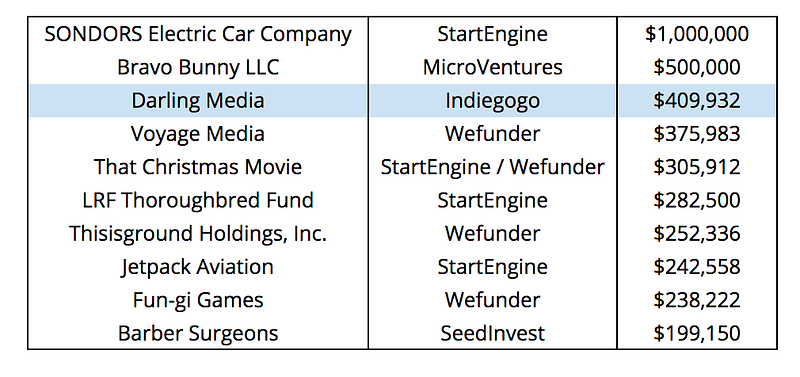

Top Ten Closed Campaigns

You gotta hit the million to make the cut.

Over 20+ companies have raised to the million dollar mark in Regulation Crowdfunding, some of which are still live and accepting investments. Those who raised past the million dollar mark, thanks to an inflation boost from the SEC to $1.07M, lead the top ten raises.

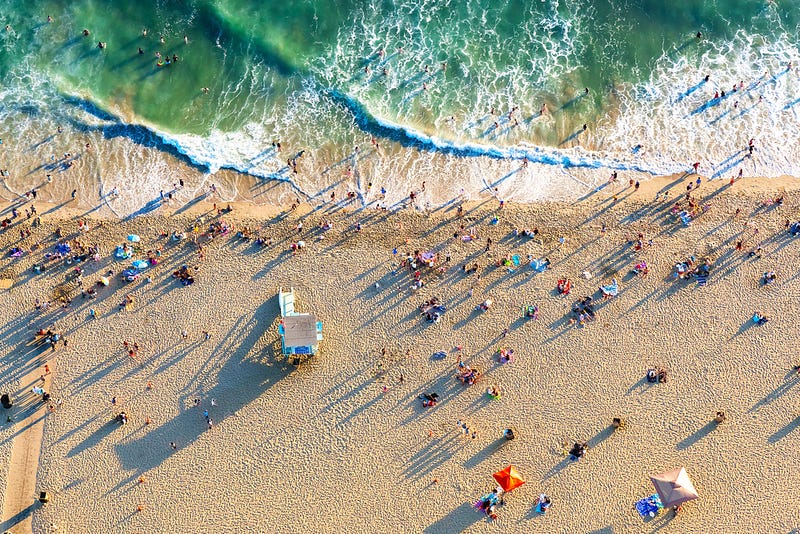

Raising in Los Angeles

The tide isn’t turning on the West Coast. At 38+ companies, LA is home to the most Regulation Crowdfunding campaigns of any county in the country.

In August, the sun set on a handful of campaigns, accounting for but rose on other. Ten LA companies submitted campaigns to the SEC in August,which is double the amount that submitted in July.

The number of live campaigns is up by three, as well, which indicates that more campaigns were launched than closed in August.

Los Angeles County by the Numbers

17

campaigns in progress. Up 3campaigns from last month.

10(!)

new campaigns submitted to the SEC in August.

3

successful closes in August.

~$1.03M

raised in August.

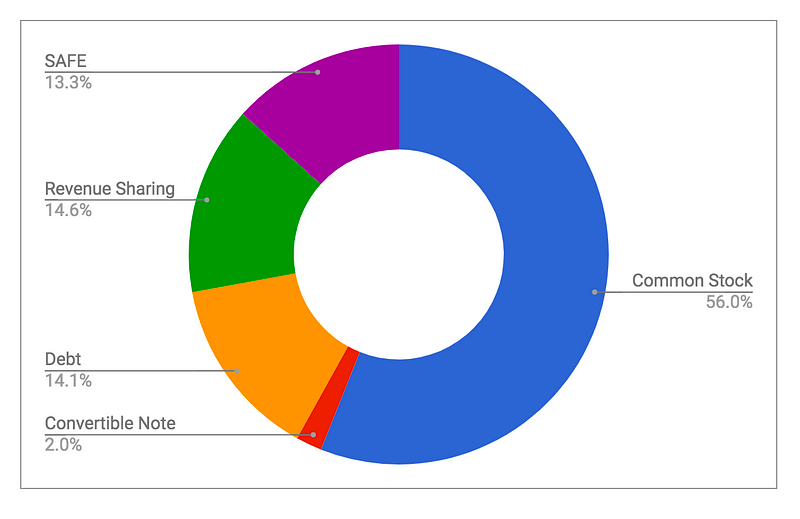

Types of Raises in LA

LA companies continue to offer Common Stock above all other security types. This month, it’s interesting to see Rev Shares on the rise, and in the second place spot. Entertainment companies raising for films or TV have been known to tread toward Rev Shares, so it makes sense to see this trend in Hollywood.

Los Angeles Top 10 All Time Raises

No company snuck into the Top 10 in August, but with 10 new contenders entering the field, it’s possible next month will be a different story. A few of the top spots have changed, primarily due to Darling Media’s $400K raise on Indiegogo.

Company Makeup in LA

Companies in LA look a bit more like startups than they do across the country. LA-companies have about 4 employees each; their average revenue is at $120K and average age is about 2.3 years.