The StartEngine Index: A Tale of Two Counties

April 2018

The following data covers Regulation Crowdfunding raises between May 16, 2016, and April 30, 2018. Data is sourced from all publicly disclosed Form C filings with the SEC, as well as public websites.

Standard Analysis

Index: 1073

Regulation Crowdfunding continues to push past the $100M mark, with this month’s Index growing by 5%, a monthly growth that has remained steady in 2018.

In April, companies raised a total of over $7.9M, bringing the total amount raised via Regulation Crowdfunding to $107.3M. Even more promising for the future, 58 new Regulation Crowdfunding offerings were filed with the SEC.

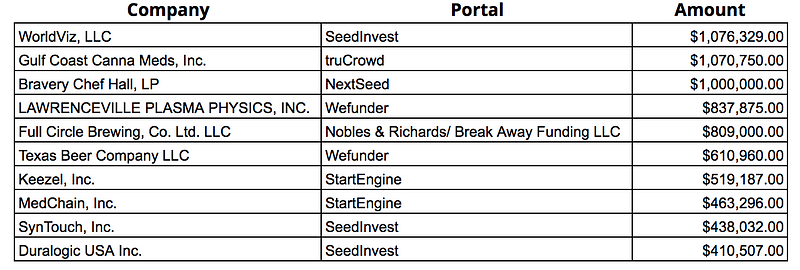

Top Campaigns in April

The top campaign this month was SeedInvest’s WorldViz, LLC, a virtual reality solution for company employee training. It’s worth noting that the top two raises this month raised more than the $1.07M cap for Regulation Crowdfunding. These raises are above the limit as these amounts denote investor commitments, not final raise amounts. This means that WorldViz and Gulf Coast Canna Meds cannot legally disburse more than $1.07M under Regulation Crowdfunding, and so some investor commitments will be returned to the investors at the end of the offering period.

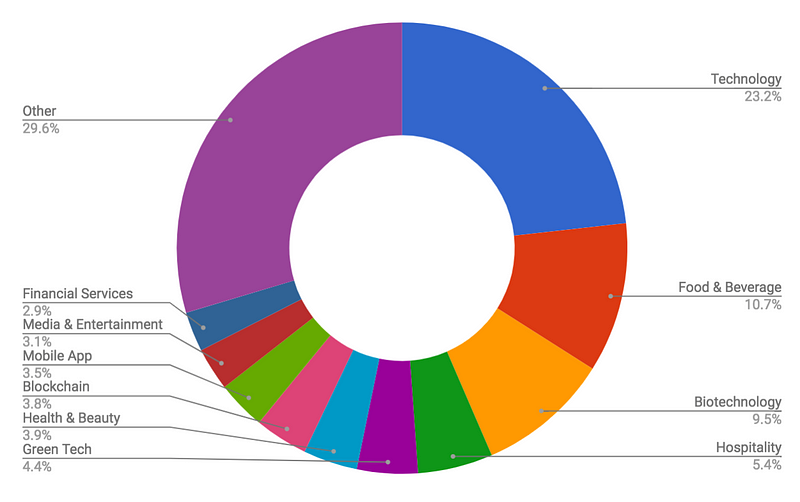

Industry

10 industries accounted for just over 2/3 of capital raised in April. The technology and food & beverage industries continue to be the top two industries at 23.2% and 10.7% respectively.

More interesting is Biotechnology’s appearance in 3rd with 9.5% of capital raised this month. Biotechnology nearly doubled its raise amount since inception with $760K raised in April alone, bringing Biotechnology’s total to just over $1.7M since Regulation Crowdfunding’s inception. This is due to six ongoing raises in the Biotechnology industry (there are only 3 offerings in Biotechnology prior to this). Looks like Biotechnology is perking up to Regulation Crowdfunding!

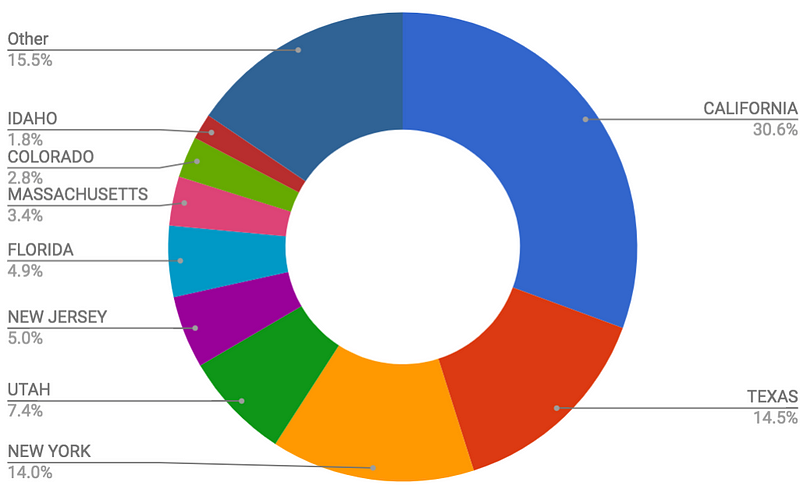

State of Operation

California, Texas, and New York continue to circle the top of Regulation Crowdfunding from month to month. And welcome Idaho to the top 10!

A Tale of Two Counties

The two counties that have raised the most capital via Regulation Crowdfunding areLos Angeles County and Travis County (Austin, Texas) with $10.9M and $6.4M respectively. Combined these two counties account

This means that on average companies in Los Angeles County raise $116k whereas companies in Travis County raise $432k.for 16% of all capital raised via Regulation

Let’s take a closer look at the data: Crowdfunding in the US, yet there are some striking differences between the two, not least of which is that Los Angeles County has launched 95 Regulation Crowdfunding offerings whereas Travis County has launched just 15.

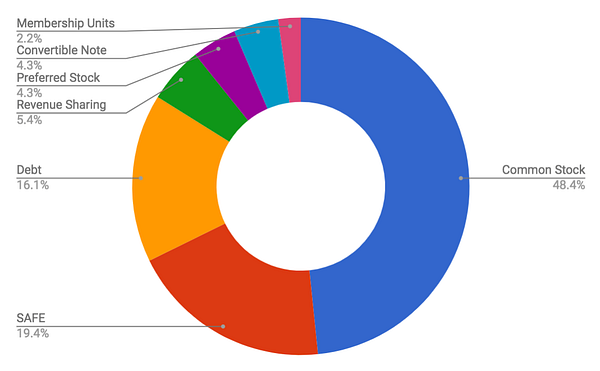

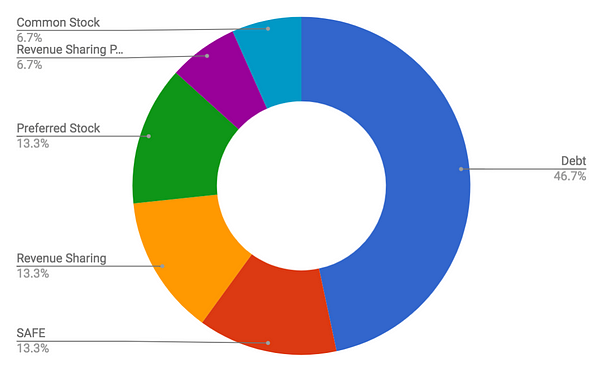

Nearly half of raises in Los Angeles were done through the sale of securities while Austin companies largely raised through debt. Interestingly, SAFE comes in second place for both counties.

Companies that raise capital through debt raise $132k on average and $106k on average through the sale of common stock.

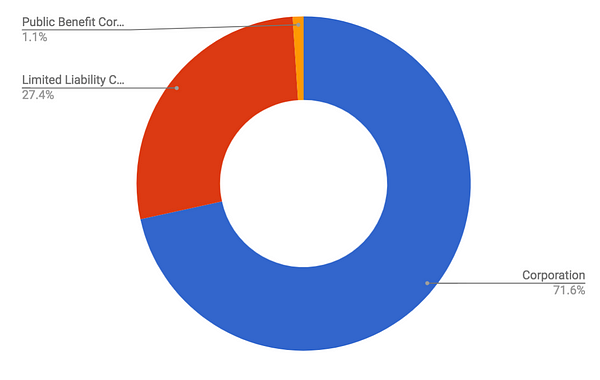

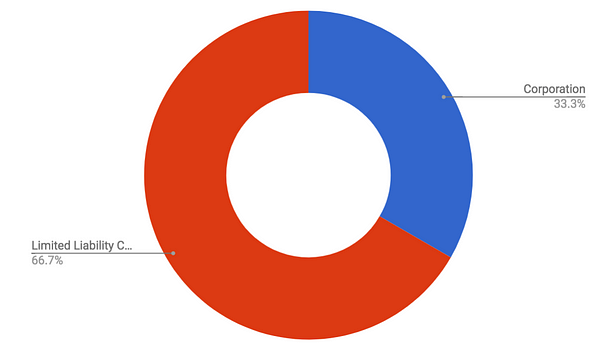

Just as Los Angeles County and Travis County showed great variation in security type, Los Angeles companies show a clear preference for registering as corporations whereas Austin companies prefer LLCs.

Corporations raise $130k on average, whereas LLCs raise $111k.

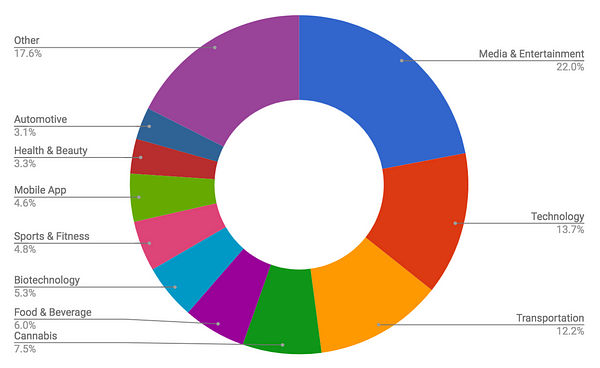

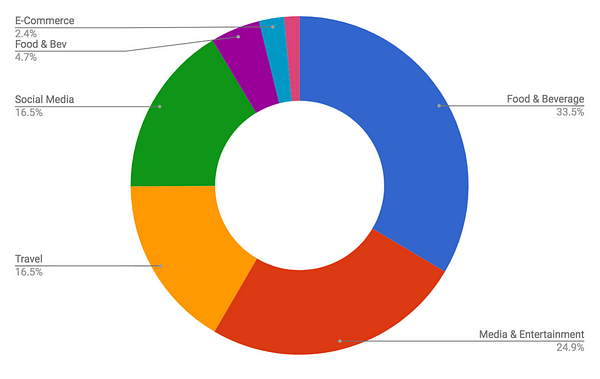

Los Angeles is the more diverse county of the two in terms of industry—no surprise given the larger campaign volume. The unlabeled portion of Travis County’s graph is Mobile Apps, which accounts for 1.5% of capital raised in the county.

On average, companies in the Food & Beverage industry raise $165k whereas Media & Entertainment companies raise an average of $91k.

Los Angeles & Travis Counties By the Numbers

30 & 2

campaigns in progress in Los Angeles & Travis County respectively

5 & 1

campaigns submitted to the SEC in the month of April in Los Angeles and Travis County respectively

$400k & $64K

raised in April in Los Angeles & Travis County respectively