The StartEngine Index: February 2018

February 2018

The following data covers Regulation Crowdfunding raises between May 16, 2016, and February 28, 2018. Data is sourced from all publicly disclosed Form C filings with the SEC, as well as public websites.

Standard Analysis

Index: 951

This month, the Index grew 5%, which is the same as the 5% growth we saw in January. It’s worth noting that this steady growth is smaller than the spike we saw in the fall of 2017, but this data supports the growth that the Index has shown month-to-month since inception.

In total, over $95.1M has been invested in Regulation Crowdfunding since May 16, 2016, and this month saw a net increase of over $5.8M in investments.

In January, over $90.7M had been raised via Regulation Crowdfunding. The difference between total capital raised to date in January and February is only $4.4M. This discrepancy is due to the fact that several campaigns failed in February, and so $1.4M was returned to investors.

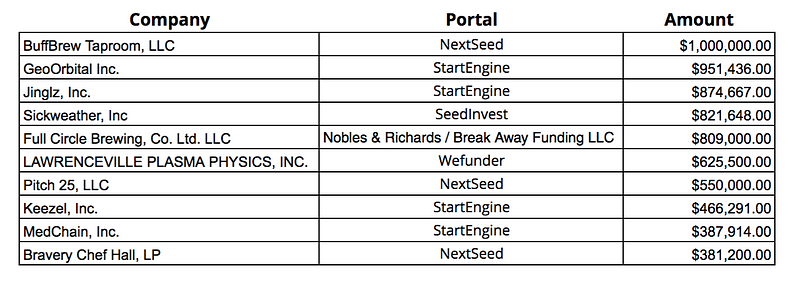

Top Campaigns in February

As in January, the highest raise this month was NextSeed’s BuffBrew Taproom’s offering, which reached its chosen maximum of $1M in January, but the campaign will remain live for 56 more days.

4 of the 10 largest offerings in February were hosted on StartEngine, 3 on NextSeed, 1 on SeedInvest and Wefunder, and 1 on Nobles & Richards, a boutique investment bank and broker-dealer appearing in the Index for the first time.

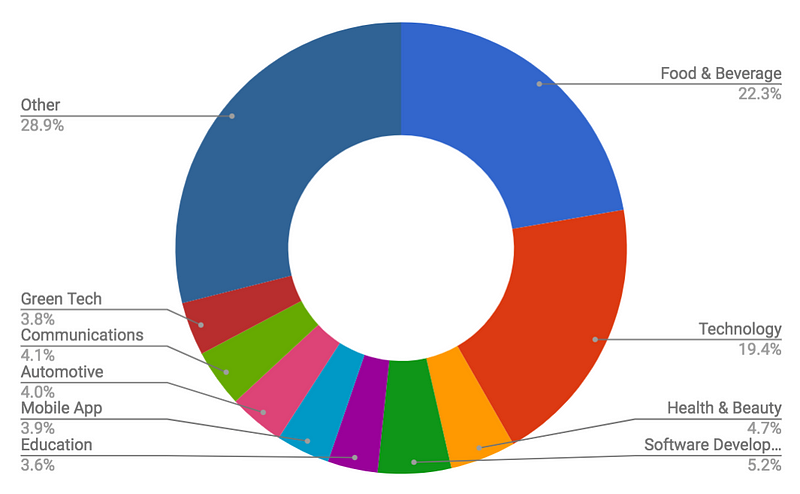

Industry

This month, the Food & Beverage industry reclaimed its spot as the industry that has raised the most via Regulation Crowdfunding at 22.3% of the market. To date, this industry has raised just over $19M through crowdfunding, the most by any industry.

In general, crowdfunding saw increased diversification this month, and apart from higher raises in the Food & Beverage and Technology industries (the two biggest industries historically in regulation crowdfunding), investors committed to offerings across a wide variety of industries.

In fact, 41 different industries raised capital through Regulation Crowdfunding in the month of February.

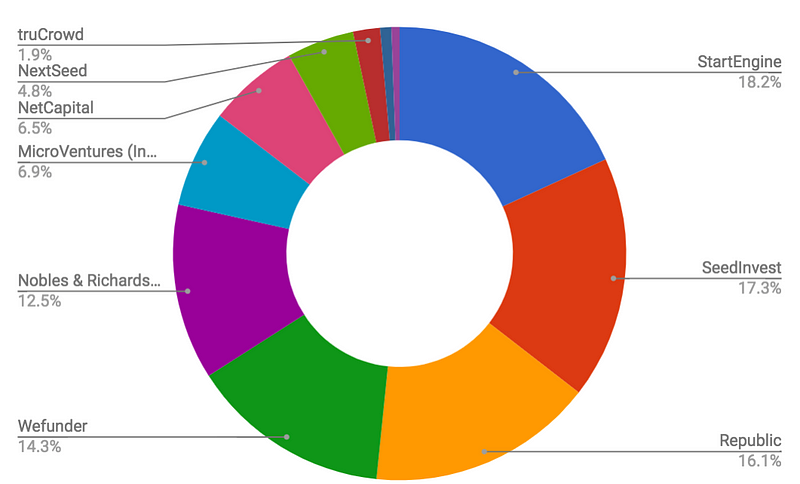

Funding Portals

During the month of February, StartEngine raised the most capital by platform, with 18.2% of February’s total. Nobles & Richards’ appearance this month is noteworthy because they are in the midst of their first ever Regulation Crowdfunding offering. Full Circle Brewing, which had raised $809k by the end of February through Nobles & Richards, single-handedly carried the portal to the top five in terms of monthly capital raised.

StartEngine and Wefunder lead the industry in terms of volume, and both platforms have hosted 177 offerings to date.

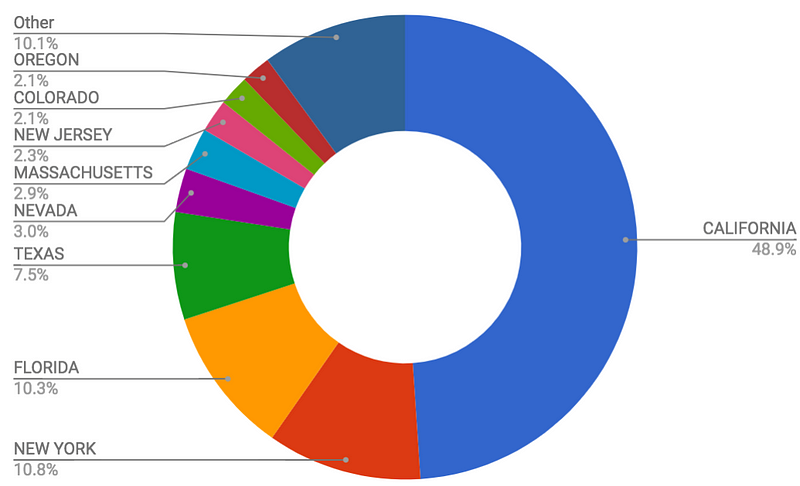

State of Operation

California continues to assert itself as the #1 state for Regulation Crowdfunding. California-based companies raised over $2.8M via Regulation Crowdfunding, which accounts for nearly half of February’s overall raise.

There are currently 71 active offerings in California alone, with 218 total active campaigns in the US.

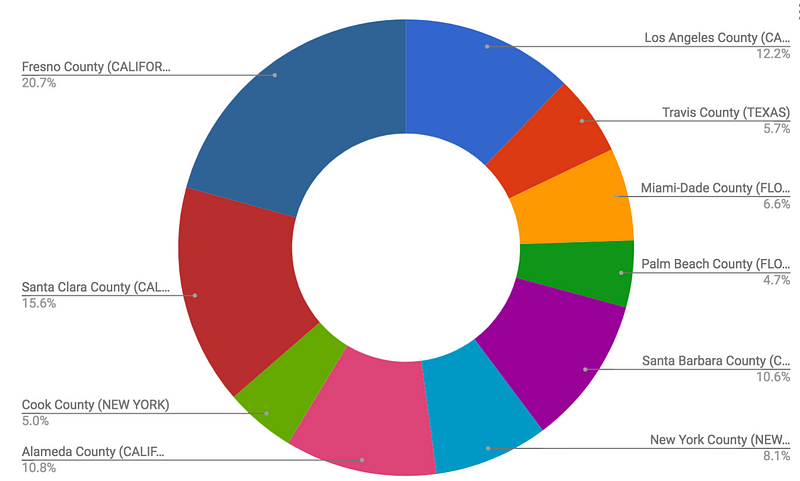

County of Operation

Tying into California’s high raise amount, the top three counties are all in California. Fresno County raise the most this month, and this was in large part due to Full Circle Brewing’s ongoing raise. Santa Clara County (just outside San Francisco) raised the second most at 15.6%, followed by Los Angeles County at 12.2%.

Raising in Los Angeles

Los Angeles has raised over $9.5 million since Regulation Crowdfunding’s inception, the most by any county in the US. Travis County in Austin, Texas follows with over $6.3M raised.

Los Angeles County by the Numbers

27

campaigns in progress — down five from last month.

2

new campaigns submitted to the SEC in February. This is down from the 6 submitted in January.

4

successful campaigns closed in February.

~$427K

raised in February.