We’re Selling Securities in All 50 States Without A Broker-Dealer

What about you?

On September 6, 2017, StartEngine flipped the switch, and we shared our SEC Form 1-A filing with the public. Yes, we are plan to launch our own Reg A Offering, on our very own platform. The primary goal is simple, raise capital so that we can grow and launch 5,000 offerings in 5 years. This is not just Reg As and Reg CFs, but possibly REITs and ICOs. Our goals are lofty, and we have our work cut out for us.

Preparing for our own raise has been a learning experience, and while the primary goal is capital for StartEngine, the raise is also an opportunity for us to experience what companies that conduct Regulation A+ offerings on our platform experience, every step of the way.

Our goal is to translate everything we have learned through our own go of it into tools for the companies raising capital on our platform.

One predicament of particular interest to companies conducting a Reg A, and to us as well, whether to use a broker dealer or not. Regulation A+ does not require a company to use a broker-dealer to sell securities. Some companies may want a broker-dealer to reach investors. But with the ease of using electronic communications to promote a Regulation A+ offering, broker-dealers may not be needed at all for many companies.

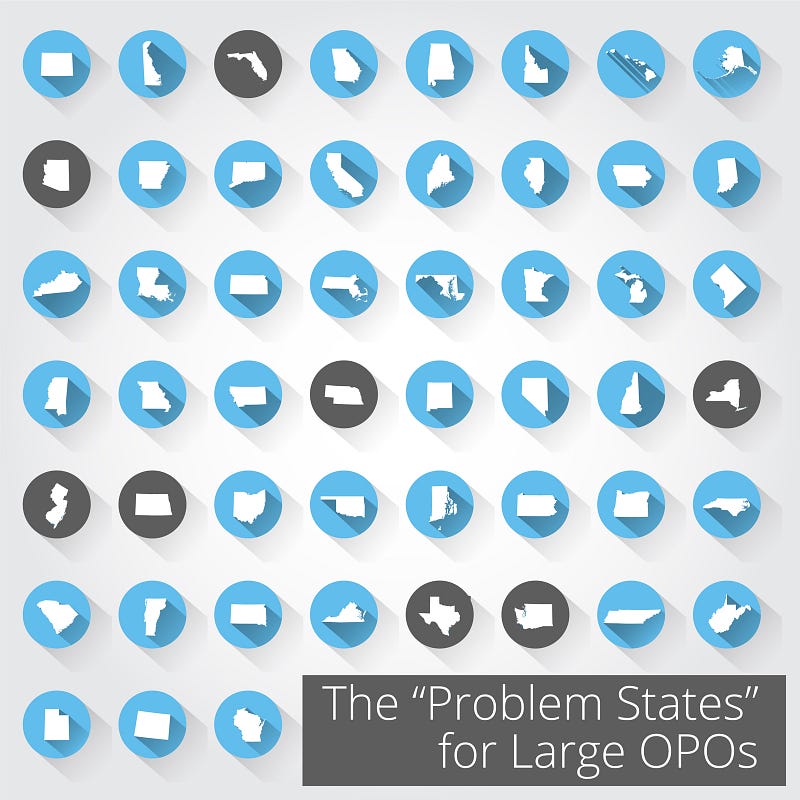

However, running a Reg A without a broker dealer stops you from selling in Arizona, Florida, Nebraska, North Dakota, Texas, Washington, New York and New Jersey. We affectionately call these the “problem states.” In order to sell securities to investors in these states via a Regulation A+ offering without a broker dealer, companies must themselves register as Issuer-Dealers or register Agents of the Issuer, depending on the specific state requirement. What shocks me is that so many companies have opted out of using a broker-dealer and chosen to accept defeat and forgo offering securities in these states — millions and millions of dollars out of reach.

We didn’t limit ourselves to 42 states, so why do others?

For one thing, it is time intensive (StartEngine is trying to change that for companies) and there are no guarantees that a company will be approved (StartEngine can’t solve that).

But we accept challenges.

For our own raise, we were certain that we wanted to go to the extra effort to sell securities in all 50 states, and we wanted to do so without a broker-dealer. A broker-dealer can be costly, and we felt we should set a precedent for our companies. The only company I know to have done this so far is Xero Shoes. (Shoutout to these ladies who provided me with a lot of information based on their experience. As one of the few companies to launch nationwide without a broker-dealer, the people at Xero Shoes are pioneers in the space).

We have submitted our dealer applications in Arizona, Florida, North Dakota, Texas, and New Jersey; New York and Washington are next. There is no guarantee that we will be approved, and we cannot sell securities in these states until we are registered as a dealer (or our offering is qualified by the SEC for that matter). However, we plan to do whatever it takes.

So yes, selling securities in all 50 states without a broker-dealer will undoubtedly add to your company’s workload, but it’s not impossible. We’re trying it first hand, and we’ve yet to be turned away.

I want to reiterate our Reg A goals: raise capital, learn, teach. With that in mind, I have created a guide to selling securities in all 50 states, based on our experience. This guide is complete with templates, forms, and step-by-step instructions. We lay it all out, as simply as possible.

If you are a company pondering a Reg A and want access to this guide, I would love to share it with you. Really. Just email me (compliance@startengine.com) and it is all yours.

See you in Jersey.