The StartEngine Index: October 2017

The following data covers Regulation Crowdfunding raises between May 16, 2016, and October 31, 2017. Data is sourced from all publicly disclosed Form C filings with the SEC, as well as public websites.

Standard Analysis

Index: 686

The index increased by 6%. The forward momentum in the equity crowdfunding marketplace continues.

Total Capital Raised

Companies have raised just over $68M since the Reg CF inception. The net increase reported from September’s Index is +$1M.

However, the September Index (and all previous indices before that) accounted for all SEC submissions, not respective raises. Occasionally companies submit duplicative material to the SEC, or close campaigns without having disbursed on funds. This report has eliminated these discrepancies, and will continue to hold this standard in future indices.

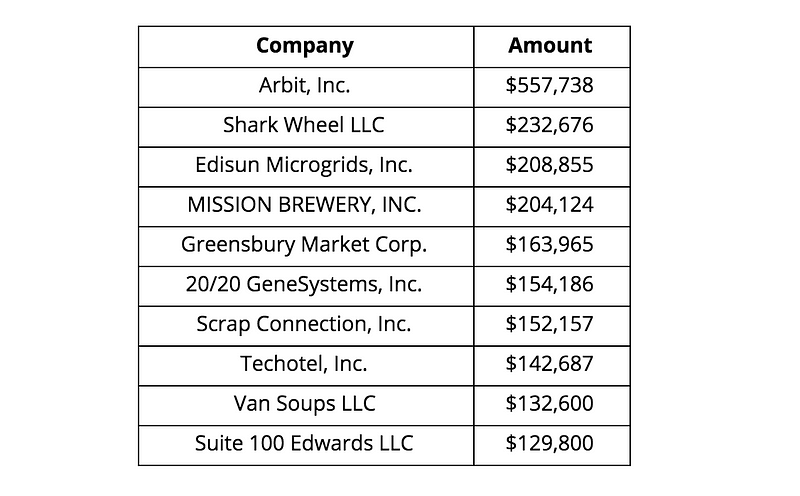

Top Companies Raising in October

The following companies were top raisers in the month of October. Arbit, a polling app (Microventures) led the way, followed by Shark Wheel (StartEngine).

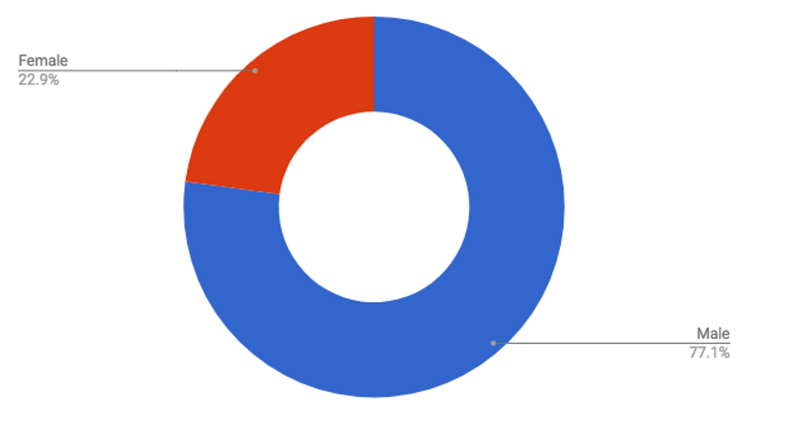

Gender

Last month we analyzed the gender of founders. The data in October has remained consistent, with at least 22% of founding teams including a female founder.

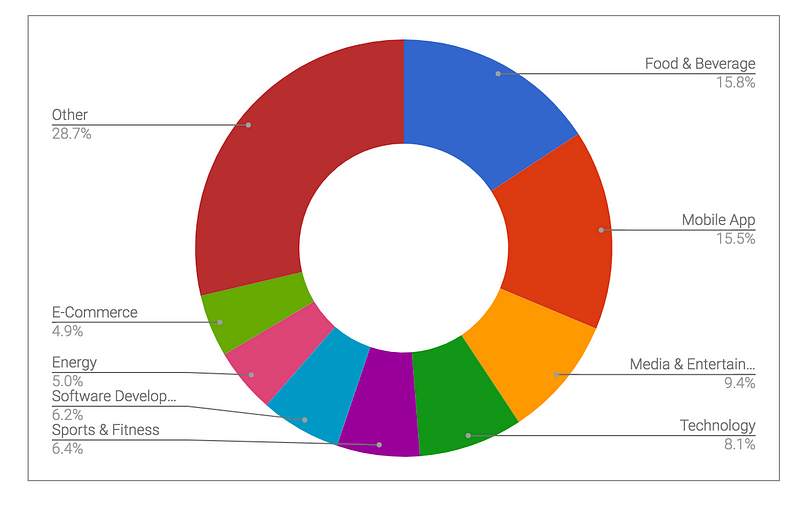

Industry

This month we looked at the industry of companies who raised capital in October. Distilleries and craft beer companies continue to be the industry receiving the most capital, at 16%, however, mobile apps are a very close second at 15% followed by media and entertainment at 9%.

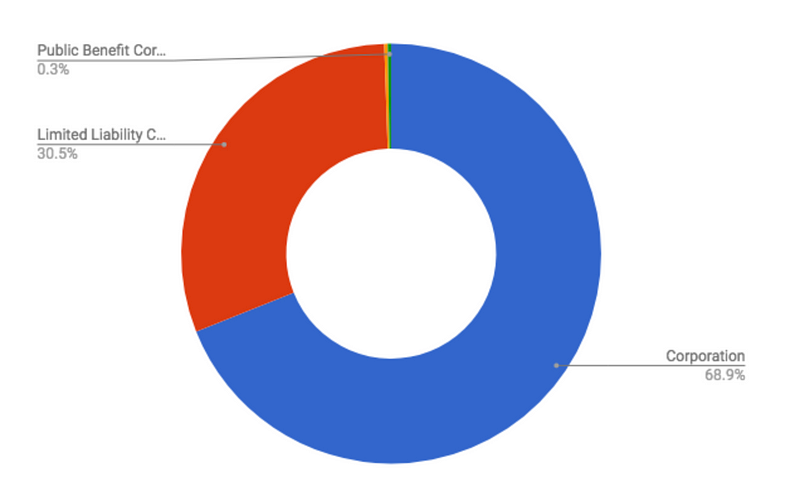

Type of Company

The mix of legal formation is showing a steady constant with 69% being corporations and 30% Limited Liability Corporations.

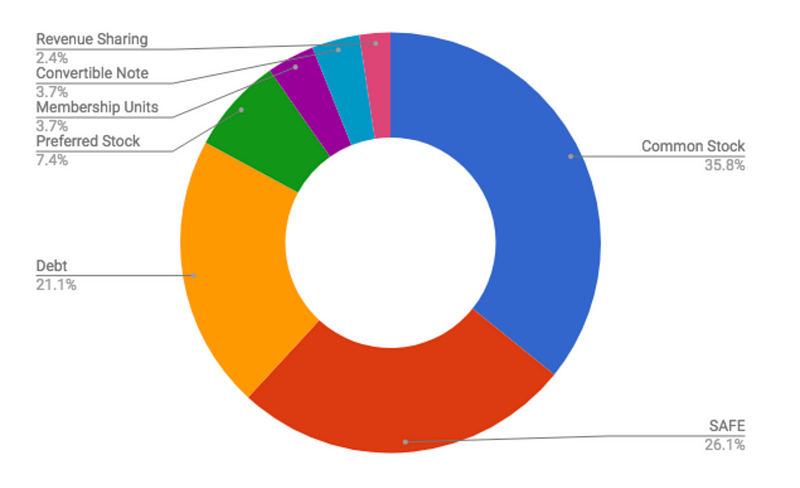

Type of Securities Offered

Companies are increasingly offering common shares with 36% of the total raises compared to 31% last month. The second most popular offering is SAFE which increased to 26% from 23%. Debt is third at 21%.

Average Company Makeup

The average company has 5 employees and has been in business for 3 years. Average assets are $380K, average cash is $80K and revenue is $348K. The average company is not profitable with a loss of $237K. These findings reveal companies are startups looking to raise capital to accelerate growth.

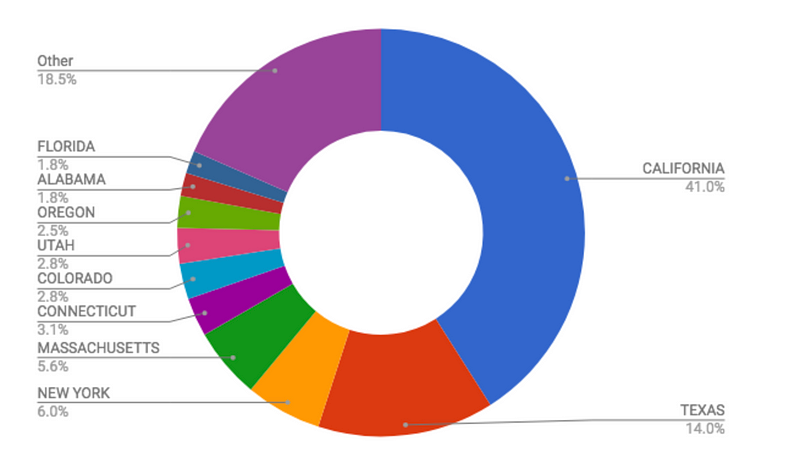

State of Operation

Companies in California raised the most money in October with $1.9M, which is 38% of the total raised. Second is Maryland with $712K.

Since inception, California accounts for 41% of all capital raised. Second is Texas with 14% and New York third at 6%.

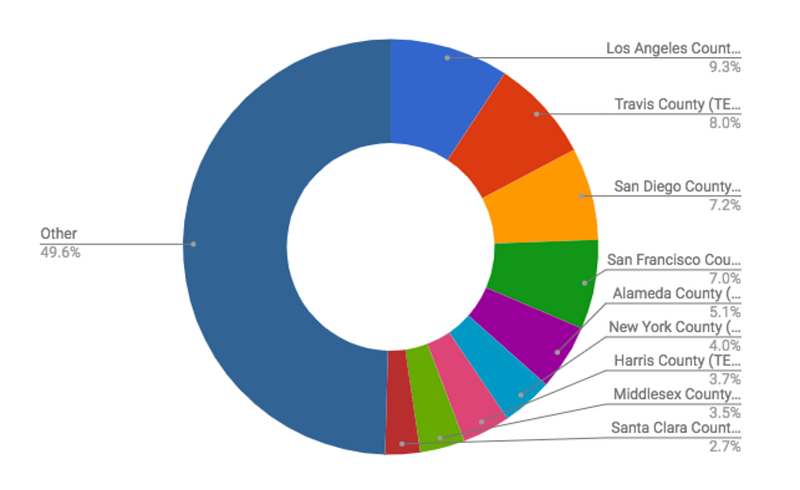

County of Operation

Los Angeles has risen this month to be the county that has raised the largest amount of capital with 9% share. Second is Travis County in Texas with 8%.

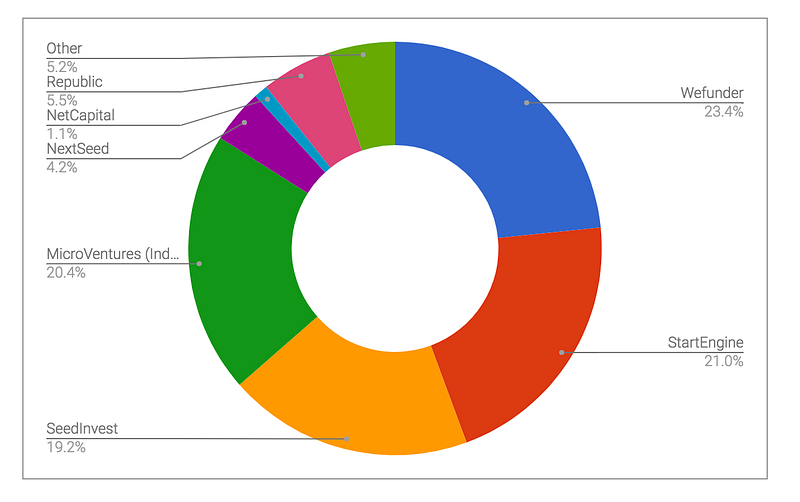

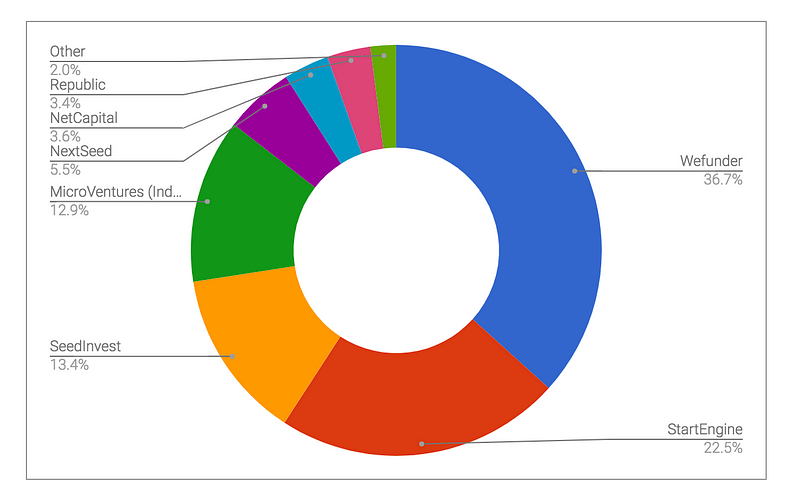

Funding Portals

In October, Wefunder and StartEngine together helped companies to raise over a million.

Wefunder is still the largest funding portal with a 37% market share followed by StartEngine at 23%, a slight increase from last month.

Raising in Los Angeles

Los Angeles continues to be the most popular place to own a company and raise through Regulation Crowdfunding. In October, over $600K was raised for these companies, up slightly from last month, and above all other counties in the nation.

Additionally, more campaigns began in October than the previous month, and most all of them are still kicking.

Los Angeles County by the Numbers

24

campaigns in progress — up 7 from last month.

8

new campaigns submitted to the SEC in October.

0

successful closes in September. They’re all still up!

~$661K

raised in October.

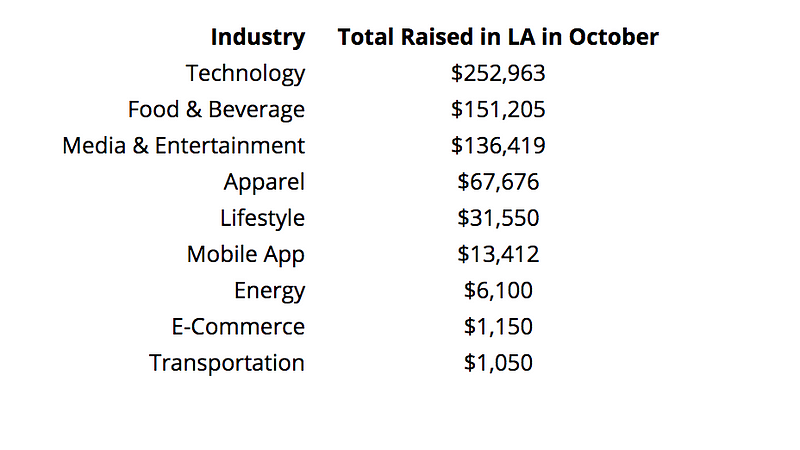

Industry in Los Angeles

Usually an entertainment town, October had LA-based tech companies taking the top spot in SoCal.