The StartEngine Index: January 2018

January 2018

The following data covers Regulation Crowdfunding raises between May 16, 2016, and January 31, 2018. Data is sourced from all publicly disclosed Form C filings with the SEC, as well as public websites.

Standard Analysis

Index: 907

The new year brings new tidings in Regulation Crowdfunding. The Index grew 5% this month, which was down compared to the 12% growth we saw in December. To date, the Index has grown steadily month-to-month. In total, over $90.7M has been invested in Regulation Crowdfunding since inception.

This month saw a net increase of over $5.3M.

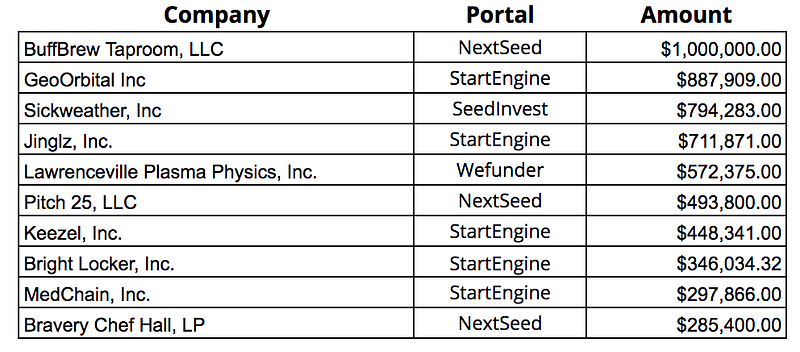

Top Campaigns in January

The highest raise this month was BuffBrew Taproom’s offering on NextSeed, which reached its chosen maximum of $1M. Of the ten largest campaigns in January, 5 were hosted on StartEngine’s platform, 3 on NextSeed, and 1 on each SeedInvest and Wefunder.

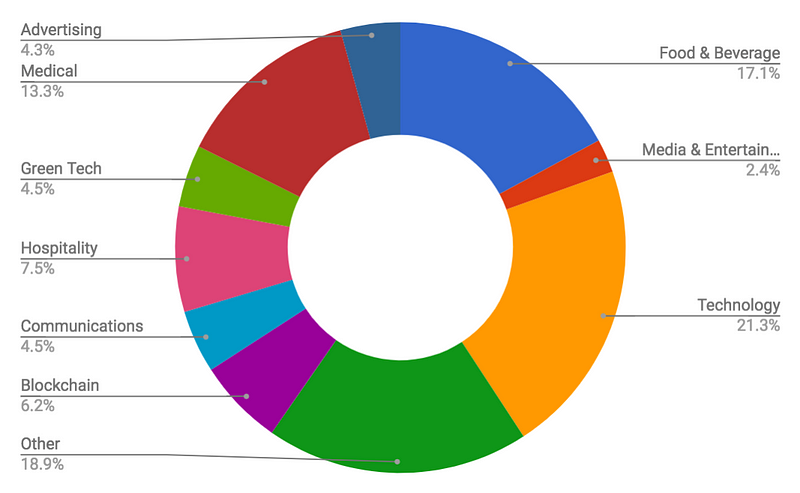

Industry

This month, the Technology industry raised the most through Regulation Crowdfunding, at 21.3% of the market share. Food & Beverage followed at 17.1%, and Medical came in third at 13.3%.

The appearance of the Medical Industry this month was a surprise and was due to the success of Sickweather’s offering on SeedInvest, which has raised $794k as of January 31st.

The Food & Beverage and Technology Industries are regularly at the top, as they have raised $17.7M and $9M respectively to date via Regulation Crowdfunding. Together, these two industries account for 29.4% of the total market share for capital raised.

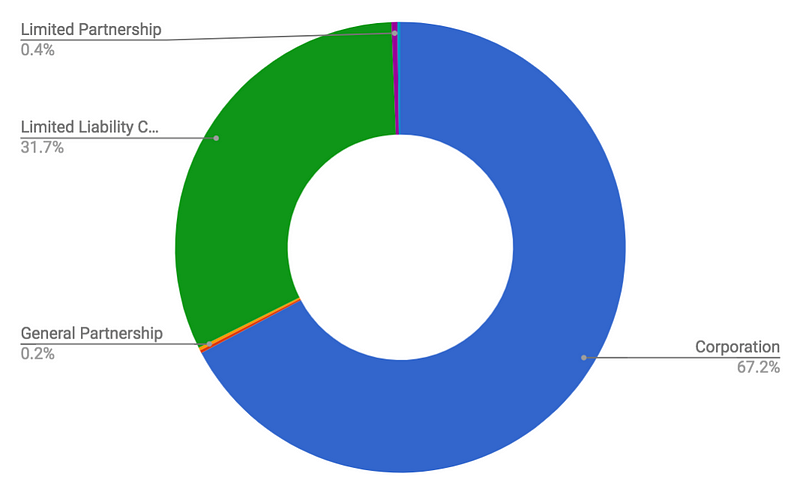

Type of Company

The mix of legal formation remained relatively constant with 67.2% of companies being Corporations and 31.7% Limited Liability Companies.

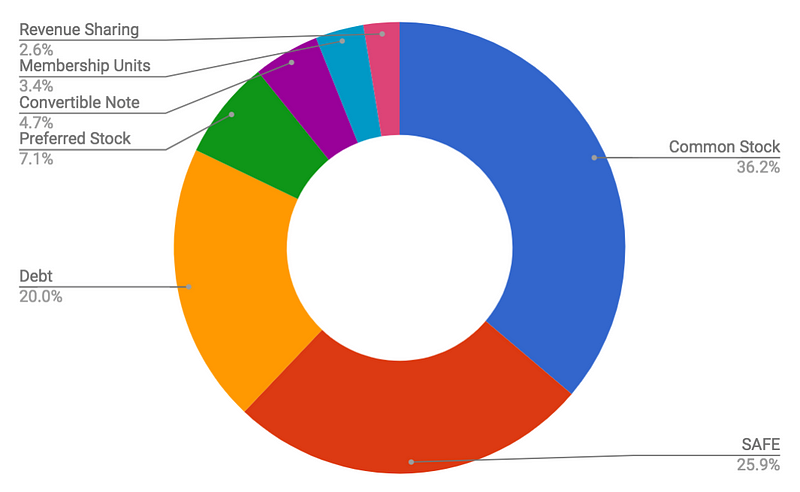

Type of Securities Offered

These numbers showed little movement this month. Campaigns offering common stock accounted for 36.2% of total offerings, campaigns offering SAFE for 25.9%, and debt for 20%.

Both common stock and debt offerings saw a slight dip as offerings featuring revenue sharing, membership units, and convertible notes all increased slightly this month.

Since Regulation Crowdfunding’s inception, we have seen different portals specialize in different offerings. To date, 79.1% of campaigns on StartEngine offered common stock, 50.3% of campaigns on Wefunder offered SAFE, and 74.6% of campaigns on SeedInvest offered debt.

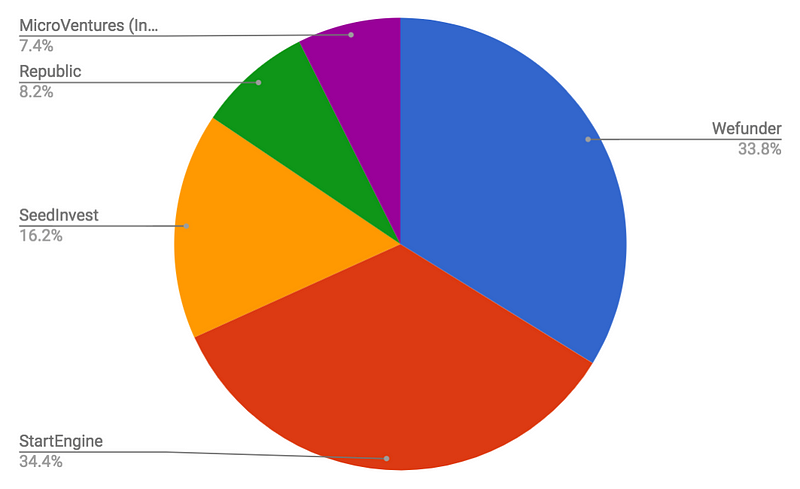

Funding Portals

Throughout 2017, Wefunder led the industry in Regulation CF offerings. However, at the start of the new year, StartEngine became the industry frontrunner in terms of campaign volume. As of January 31st, StartEngine has hosted 168 unique offerings, accounting for 33.8% of campaigns on the five largest funding portals. Wefunder is just three offerings behind at 165, and SeedInvest at 79.

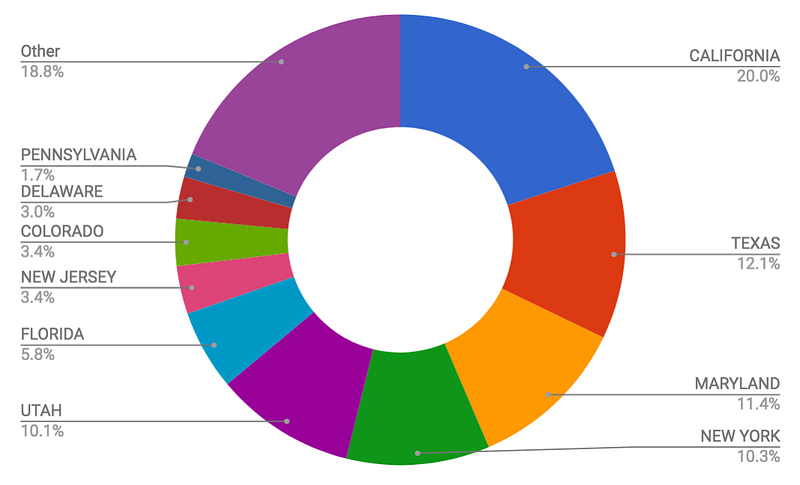

State of Operation

California remained on top in January, with companies raising more than $1.2M via Regulation Crowdfunding this month.

This accounted for 20% of the capital raised in January. Texas came in second at 12.1%, and Maryland, who made its first appearance in the Top 5 States of Operation last month, moved up a spot into third place at 11.4%.

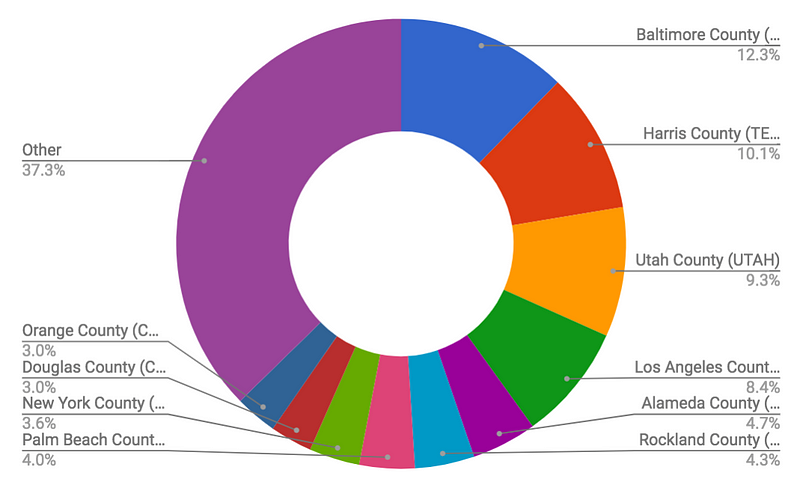

County of Operation

Urban counties continued to lead crowdfunding in the new year. This month, Baltimore County led the United States with 12.3% of the total amount raised by Regulation Crowdfunding. This was the first time Baltimore has been the leader in crowdfunding in terms of monthly capital raised, and this was due to the success of Sickweather’s campaign on SeedInvest.

Harris County (Houston, Texas) followed with 10.1%, and Utah County came in third with 9.3% of total capital raised in January.

Raising in Los Angeles

At $9.1 million raised since Reg CF’s inception, Los Angeles continues to prove itself to be a central hub for Regulation Crowdfunding in 2018 and has raised the most out of any county in the US.

However, the capital raised in Los Angeles remained low in January, compared to the fall of last year, despite January’s high number of campaigns in progress.

Los Angeles County by the Numbers

32

campaigns in progress — down 3 from last month.

6

new campaigns submitted to the SEC in January. No change from December.

1

successful campaign closing in January.

~$450K

raised in January.