The StartEngine Index: March 2018

March 2018

The following data covers Regulation Crowdfunding raises between May 16, 2016, and March 31, 2018. Data is sourced from all publicly disclosed Form C filings with the SEC, as well as public websites.

Standard Analysis

Index: 1021

As the first quarter of 2018 draws to a close, Regulation Crowdfunding crosses a major milestone. Regulation Crowdfunding has officially raised over $100M in the United States! As of March 31, Reg CF campaigns have raised $102.1M. Here’s a picture of a dog to celebrate:

Let’s take a quick look at industry numbers since May 2016:

There are now 41 FINRA-registered funding portals.

66 different industries have raised capital with Regulation Crowdfunding.

Companies in 42 states have raised capital via Regulation Crowdfunding.

There have been 802 offerings.

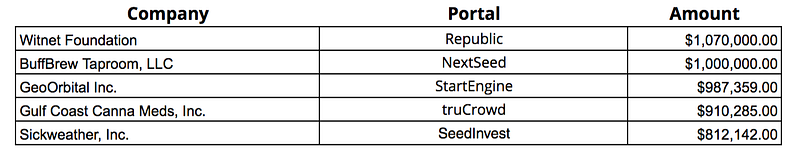

Top Campaigns in March

In the month of March, investors committed just over $8M to Regulation Crowdfunding offerings. BuffBrew Taproom dropped a spot as Republic’s Witnet Foundation claimed the largest raise in March. The smart contract network reached its maximum in just 25 days and single-handedly almost doubled the total raise amount for the state of Washington since inception.

The remaining companies in the top five include a brewery, a wheel that turns any bicycle into an electric bike, a marijuana grower, and an app that tracks where people are sick. Businesses as diverse as the platforms they are hosted on.

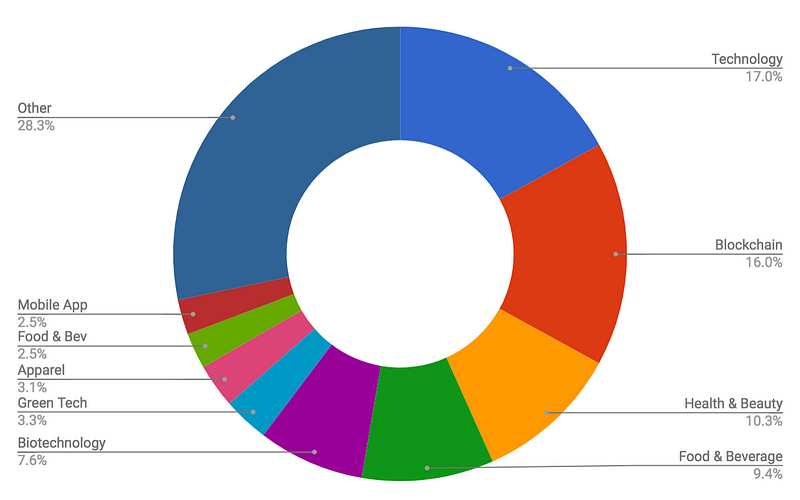

Industry In March

Technology is back on top as the industry that has raised the most via Regulation Crowdfunding in March with $1.36M raised. More interesting is Blockchain’s appearance at 16% of capital raised at $1.27M, a 54% increase in overall capital raised in the blockchain industry (due to Witnet’s successful raise). The crypto market may be bearish, but there’s no sign of it in Regulation Crowdfunding.

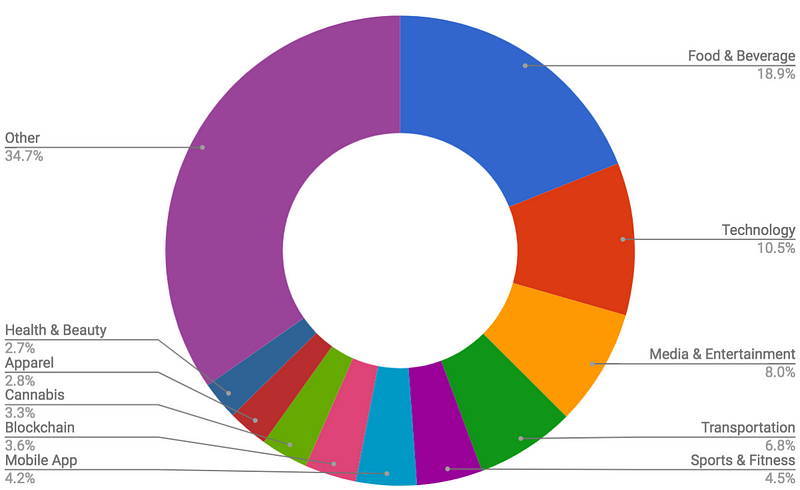

Industry Since Inception

However, in terms of capital raised since inception, the Food & Beverage industry has a substantial foothold on the industry with $19.3M raised, nearly 20% of Regulation Crowdfunding’s first $100M. Technology companies have raised $10.7M, and Media & Entertainment companies $8.2M.

Gender

Did you know that every founder who has raised capital in West Virginia is female? For states with more than 10 Regulation Crowdfunding offerings, Pennsylvania and Nevada have the highest percentage of female founders at 33.3% each. For context, the national average is 22.1%.

Nationwide, male founders have raised $79.1M via Regulation Crowdfunding and female founders have raised $21.6M to date. However, on average, male founders raise only 3% more than female founders via regulation crowdfunding. While 3% means there is still improvement to be made, this is a significantly smaller gap than the 58% gap in average venture capital raises between male and female founders.

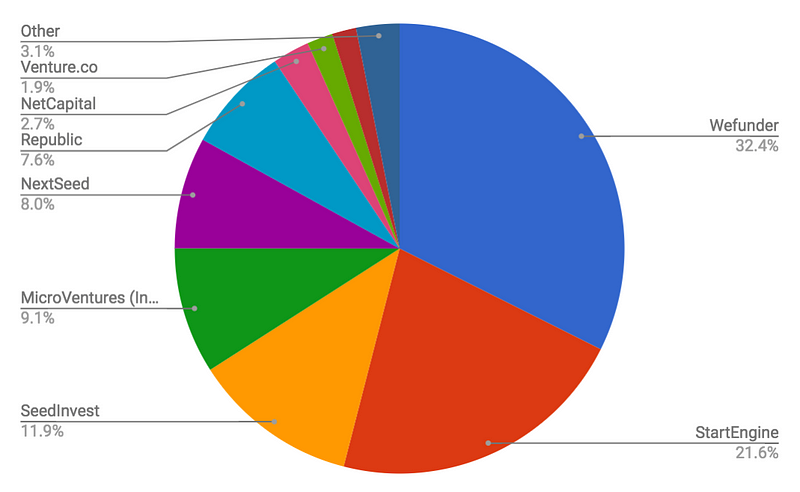

Funding Portals

Here is how the first $102M raised by Regulation Crowdfunding breaks down. Wefunder leads the pack with $33M, and StartEngine follows at $22M. In March, Republic had the most momentum for raised capital with $1.79M, and StartEngine had the most momentum in terms of campaign volume with 20 new launches.

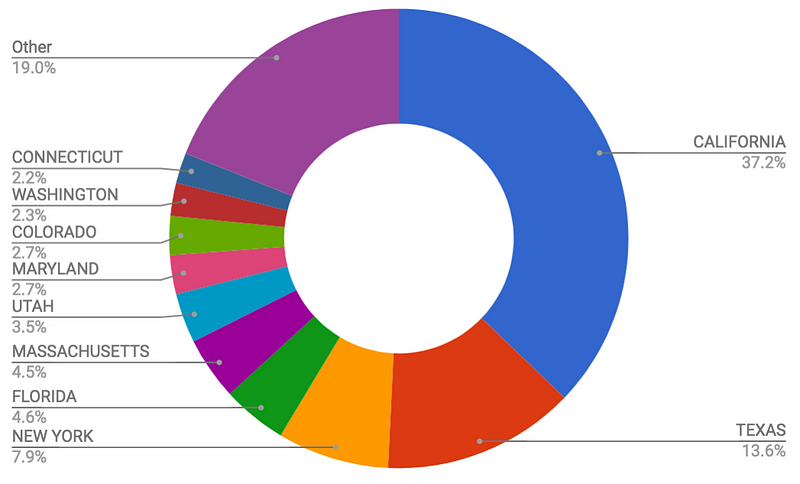

State of Operation

California has proven itself as the home of Regulation Crowdfunding with $37.9M raised since inception. Texas follows with $13.8M.

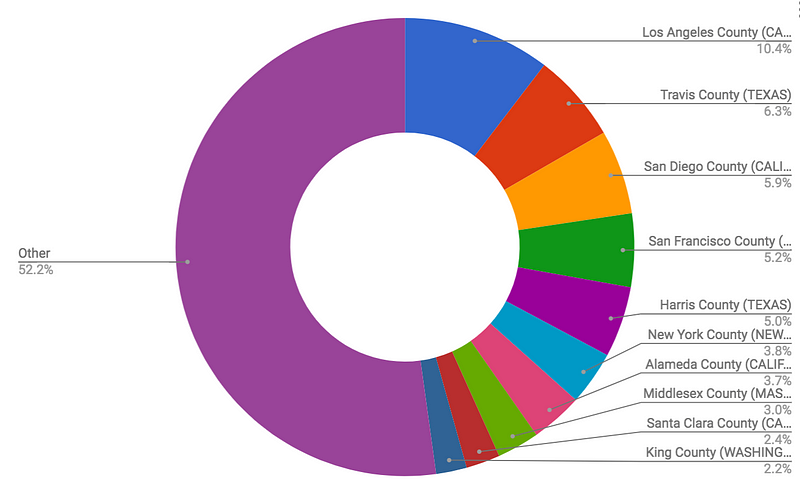

County of Operation

The 10 counties that have raised the most via Regulation Crowdfunding account for nearly 50% of capital raised through Regulation Crowdfunding. Unsurprisingly, given California’s high raise amount, 5 of the top 10 counties are located in California.

Austin, Houston, New York City, Boston, and Seattle make up the remaining five counties, which supports the idea that most crowdfunding offerings are done by businesses in metro areas.

Raising in Los Angeles

31

campaigns in progress — same as last month

6

new campaigns submitted to the SEC, up from 2 in February

0

successful closings in March

~$1M

raised in February.

~$10.6M

raised to date.