CLOSED

GET A PIECE OF BEANSTOX

Seriously Simple Investing

Beanstox is focused on a large consumer market, providing automated wealth building designed primarily for the 100 million Americans who have no investment account. We call it Seriously Simple Investing®. Kevin O’Leary is well-known from Shark Tank and has a social media footprint of 5M+ users across his platforms, which we believe gives Beanstox a significant marketing advantage and potential for accelerated growth.

REASONS TO INVEST

The Problem

Investing is difficult for many people

At Beanstox, we believe the choices for personalized investing are limited for middle-income people as traditional financial service providers often have high minimums, such as $100,000, with annual fees as high as 1% of assets under management, which is $1,000/yr, while lower cost choices provide limited or no personalized management. Unfortunately, many adults are heading to a retirement of poverty - in fact, over 100 million households do not have an investment account and are not saving and investing for retirement.

*Data as of 2013.

Many Americans who are only saving but not investing are missing the power of compounding returns that could greatly improve their financial wealth and retirement savings over the course of their lifetime. Someone only saving $100/week over 40 years, but not investing and assuming no interest accrual, would save $208,000; however by investing the same $100/week for 40 years at an estimated annualized return of 8% (including reinvestment of dividends and excluding fees and taxes), invested in a properly diversified portfolio for the entire period and keeping the funds invested throughout the entire investment period, an investor could end up with over $1.5 million. Beanstox helps make the power of compounding returns accessible to all people.

*Simple saving assumes no interest rate accrual.

**Assumes an annualized market return of 8%, below the 30 and 40-year annualized market return for the S&P 500. Actual returns will vary greatly and depend on personal and market conditions. Past performance does not guarantee future result.

This chart does not reflect fees or costs associated with investing. It is not indicative of past performance or any client's experience using the Beanstox App.

The Solution

Make investing seriously simple

Our team at Beanstox developed an app that enables people to start investing in minutes. We realized that an effective solution must be serious, simple, and personalized to each client, designed to combine saving with automated investing to “use the power of compounding”. We also realized the benefits of providing people an investment approach similar to the way Kevin O’Leary invests for his family’s wealth.

Automated investing

Clients receive personalized portfolios and recommendations based on their individual investment goals and risk tolerance levels. Clients set the amount they want to add to each investment goal every week or month, which is then automatically invested.

Straightforward subscription model with a low minimum investment

Many clients appreciate our simple monthly subscription fee of $5*, with no hidden fees or surprising charges, allowing clients to start investing with as little as $100. Most clients (as of 3/31/21) start with over $500 and approximately 80% use the automated investment service, most choosing to add $200 or more per month.

*This membership fee covers costs associated with portfolio advisory services, custody, account maintenance and trade execution but additional services may incur additional fees, and the fee does not include fees and expenses charged by ETFs to their shareholders. Learn about fees here.

Recurring deposits

Set weekly or monthly recurring deposits for each goal, the client decides. Depending on how much you invest, the app will show you the potential return you can expect (based on the number of years you stay fully invested). Most clients, approximately 80%, use the automated recurring deposit feature provided by Beanstox.

video

The Market

The robo-advisory market expected to soon manage over $16 trillion of assets

Market studies indicate that the worldwide robo-advisory market is expected to grow to $16 trillion of assets under management forecasted by 2025. Among the 100 million Americans with no investment account, we believe that about 30-40 million people in the U.S. will open a robo-advisory account in the next five years.

Our Traction

Kevin O'Leary’s impact of media coverage as Beanstox cofounder

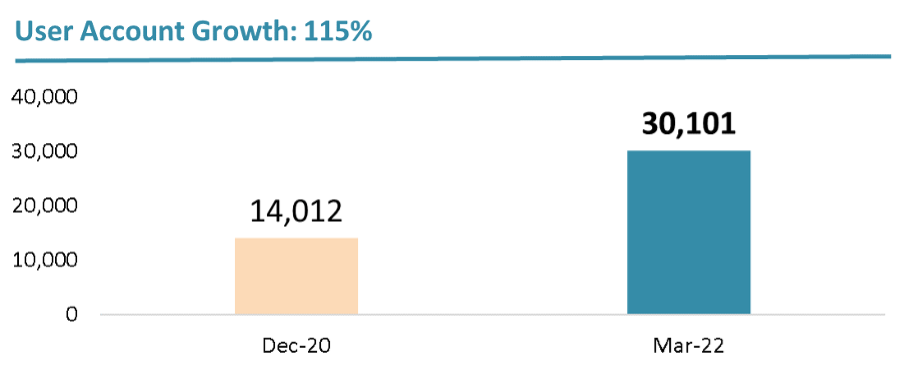

Beanstox has grown since the $1.07 million crowdfunding completed a few months ago. We've grown to over 60,000 downloads, 30,000 user accounts; 13,000 approved accounts; and 1,400 clients subscribed at $5/month/client. User accounts grew 115% from 12/20 to 3/22 on limited marketing. We believe there is potential for significant growth, and that we are sufficiently differentiated from our peers.

Data as of 3/31/2022

Beanstox cofounder, Kevin O’Leary, is widely recognized as a savvy investor, and a brand trusted by many. He is known across America as an investor on the very popular show Shark Tank, as well as a contributor on CNBC and more. O’Leary, in media appearances and articles, helps build the Beanstox brand and generate thousands of downloads. His expected marketing impact includes exposure in traditional media, increased value in paid media, and broad growing exposure in social media with his following of over 3 million people across all his platforms.

What We Do

An easy to use app, for automated investing and wealth building

The Beanstox app is both simple to use and serious about investing. Our technology uses each client’s investment goals and risk tolerance levels to determine an appropriate personalized portfolio, built using diversification across selected ETFs (Exchange Traded Funds). Our investment approach reflects Kevin O’Leary’s investment principles: keep it simple, keep investing, keep portfolios diversified.

Beanstox has already established an automated wealth management platform, with business partners and required capabilities for technology, account opening, KYC/AML, banking data connections, brokerage and custody, investing, account management, reporting and more.

The Business Model

B2C subscription-based business model, with low operational costs

Beanstox uses a straightforward subscription model: $5/Month. The variable costs per user are ~$1/Month, including bank connection, securities trading, account maintenance and reporting costs. Fixed costs include our core team and marketing expenses. We could achieve break-even with 30,000 clients based on current costs.

How We Are Different

Instant marketability meets maximum accessibility

Kevin O’Leary’s reputation as an investing expert, widely featured in traditional media, gives our brand a clear advantage in the marketplace. Our brand begins with an established sense of trust among many consumers.

Our app features set us apart from our competitors: keep it simple yet serious; provide multi-goal investing; automate almost everything; provide serious info on personal finance; provide access to livestream education with Kevin O’Leary and expert guest speakers.

Some apps provide “round up” investing or enable users to invest their spare change, while other apps provide services for more affluent investors. Beanstox fits somewhere in the middle as a way for middle income Americans to start seriously investing a target amount, such as $100 each week or month, working their way toward financial freedom.

*Graph developed based on internal research

The Vision

Empowering millions to use automated wealth building and integrated mobile banking services to attain financial freedom

Beanstox’s vision is to become a leading personal financial platform for the millions of middle-income households considered “too small” by traditional wealth management service providers, and charged fees considered “expensive” by their traditional banks. Beanstox successfully launched automated wealth in March 2020, followed by a recent app redesign in February 2021, and increased its client base growth. Beanstox is also evaluating the potential to make investing and banking even easier by introducing Beanstox mobile banking (neobank model), with integrated cost-effective banking services, aiming to improve client service and accelerate growth. Neobanks are fintech companies providing digital banking services exclusively through mobile applications or websites. They do not have traditional physical branch locations, have reduced employee costs and some leverage the banking infrastructure provided by partner banks. The $27 billion neobank market has already experienced growth with an estimated 39 million users globally.

Our Team

On a mission to make financial freedom more accessible

Beanstox was cofounded by Chairman and brand ambassador, Kevin O’Leary, and CEO, Connor O’Brien. Kevin O'Leary has worked closely with the company’s core team since it’s development. The Beanstox team members have experience with investment management, digital marketing, customer service, compliance and more. With Kevin O’Leary giving Beanstox the unique edge of high impact marketing, we are focused on delivering a high-quality client experience. Our team now also includes professionals with experience in wealth management from major firms.

Why Invest

Now is your opportunity to become a part of our long-term growth

Beanstox is focused on helping millions of people grow their wealth over time and achieve financial freedom in a way that works for them. Our ability to achieve our goals will be accelerated by inviting like-minded people to become Beanstox clients and owners. As an Investor in Beanstox, become a part of our long-term growth plan.

ABOUT

HEADQUARTERS

75 State Street, Suite 100

Boston, MA 02109

WEBSITE

View Site

Beanstox is focused on a large consumer market, providing automated wealth building designed primarily for the 100 million Americans who have no investment account. We call it Seriously Simple Investing®. Kevin O’Leary is well-known from Shark Tank and has a social media footprint of 5M+ users across his platforms, which we believe gives Beanstox a significant marketing advantage and potential for accelerated growth.

TEAM

Kevin O'Leary

Chairman & Co-Owner

Connor O'Brien

CEO, President, Director & Co-Owner

Louise Anne Poirier

Chief Financial Officer & Chief Compliance Officer

Carrie Farnsworth

Adviser

TERMS

Beanstox

Overview

PRICE PER SHARE

$1.25

DEADLINE

Apr. 28, 2022 at 6:59 AM UTC

VALUATION

$26.98M

FUNDING GOAL

$10k - $3.93M

Breakdown

MIN INVESTMENT

$250

MAX INVESTMENT

$107,000

MIN NUMBER OF SHARES OFFERED

8,000

MAX NUMBER OF SHARES OFFERED

3,143,999

OFFERING TYPE

Equity

ASSET TYPE

Common Stock

SHARES OFFERED

Class B Non-Voting Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum Number of Shares offered subject to adjustment for bonus shares. See Bonus info below.

Company Perks*

Early Bird

First 72 hours - Friends and Family - 20% bonus shares

Next 72 hours - Super Early Bird Bonus - 10% bonus shares

Next 7 days - Early Bird Bonus | 5% bonus shares

Volume

$5,000+ 5% bonus shares

$10,000+ 10% bonus shares

*All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

Beanstox Inc. will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Class B Non-Voting Common Stock at $1.25/ share, you will receive and own 110 shares for $125. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investors eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will only receive a single bonus, which will be the highest bonus rate they are eligible for.

Irregular Use of Proceeds

The Company might incur Irregular Use of Proceeds that may include but are not limited to the following over $10,000: Vendor payments.

ALL UPDATES

REWARDS

Owner’s Bonus

Owner’s Bonus Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

JOIN THE DISCUSSION

0/2500

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

Crowdfunding

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000, are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, he/she is limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market, or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancelation period. Once the four-hour window has passed, it is up to each company to set their own cancelation policy. You may find the company’s cancelation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to get sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

PREVIOUSLY CROWDFUNDED

MIN INVEST

VALUATION

Important Message

IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. INVESTMENTS ON STARTENGINE ARE SPECULATIVE, ILLIQUID, AND INVOLVE A HIGH DEGREE OF RISK, INCLUDING THE POSSIBLE LOSS OF YOUR ENTIRE INVESTMENT.

www.StartEngine.com is a website owned and operated by StartEngine Crowdfunding, Inc. (“StartEngine”), which is neither a registered broker-dealer, investment advisor nor funding portal.Unless indicated otherwise with respect to a particular issuer, all securities-related activity is conducted by regulated affiliates of StartEngine: StartEngine Capital LLC, a funding portal registered here with the US Securities and Exchange Commission (SEC) and here as a member of the Financial Industry Regulatory Authority (FINRA), or StartEngine Primary LLC (“SE Primary”), a broker-dealer registered with the SEC and FINRA / SIPC . You can review the background of our broker-dealer and our investment professionals on FINRA’s BrokerCheck here. StartEngine Secondary is an alternative trading system (ATS) regulated by the SEC and operated by SE Primary. SE Primary is a member of SIPC and explanatory brochures are available upon request by contacting SIPC at (202) 371-8300.StartEngine facilitates three types of investment opportunities:

1) Regulation A offerings (JOBS Act Title IV; known as Regulation A+), which are offered to non-accredited and accredited investors alike. These offerings are made through StartEngine Primary, LLC (unless otherwise indicated). 2) Regulation D offerings (Rule 506(c)), which are offered only to accredited investors. These offerings are made through StartEngine Primary, LLC. 3) Regulation Crowdfunding offerings (JOBS Act Title III), which are offered to non-accredited and accredited investors alike. These offerings are made through StartEngine Capital, LLC. Some of these offerings are open to the general public, however there are important differences and risks.

Any securities offered on this website have not been recommended or approved by any federal or state securities commission or regulatory authority. StartEngine and its affiliates do not provide any investment advice or recommendation and do not provide any legal or tax advice concerning any securities. All securities listed on this site are being offered by, and all information included on this site is the responsibility of, the applicable issuer of such securities. StartEngine does not verify the adequacy, accuracy, or completeness of any information. Neither StartEngine nor any of its officers, directors, agents, and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy, or completeness of any information on this site or the use of information on this site. See additional general disclosures here.By accessing this site and any pages on this site, you agree to be bound by our Terms of use and Privacy Policy, as may be amended from time to time without notice or liability.Canadian Investors

Investment opportunities posted and accessible through the site will not be offered to Canadian resident investors. Potential investors are strongly advised to consult their legal, tax and financial advisors before investing. The securities offered on this site are not offered in jurisdictions where public solicitation for offerings is not permitted; it is solely your responsibility to comply with the laws and regulations of your country of residence.

California Investors Only – Do Not Sell My Personal Information (800-317-2200). StartEngine does not sell personal information. For all customer inquiries, please write to contact@startengine.com.StartEngine Marketplace

StartEngine Marketplace (“SE Marketplace”) is a website operated by StartEngine Primary, LLC (“SE Primary”), a broker-dealer that is registered with the SEC and a member of FINRA and the SIPC.StartEngine Secondary (“SE Secondary”) is our investor trading platform. SE Secondary is an SEC-registered Alternative Trading System (ATS) operated by SE Primary that matches orders for buyers and sellers of securities. It allows investors to trade shares purchased through Regulation A+, Regulation Crowdfunding, or Regulation D for companies quoted on SE Secondary.

StartEngine Bulletin Board ("SE BB") is a bulletin board platform that advertises interest in shares of private companies that previously executed Reg CF or Reg A offerings. SE BB enables shareholders to communicate interest in potential sales of shares in private companies and investors to discover, review, and potentially invest in private companies. As a bulletin board platform, SE BB provides a venue for investors to access information about private company offerings and connect with potential sellers. SE BB is distinct and separate from SE Secondary. SE Secondary facilitates the trading of securities by matching orders between buyers and sellers and facilitating executions of trades on the platform. While a security may be displayed on the bulletin board, these securities will be subject to certain restrictions which may prevent the ability to buy and sell these securities in a timely manner, if at all. Even if a security is qualified to be displayed on the bulletin board, there is no guarantee an active trading market for the securities will ever develop, or if developed, be maintained. You should assume that you may not be able to liquidate your investment for some time or be able to pledge these shares as collateral.

The availability of company information does not indicate that the company has endorsed, supports, or otherwise participates with StartEngine. It also does not constitute an offer to provide investment advice or service. StartEngine does not (1) make any recommendations or otherwise advise on the merits or advisability of a particular investment or transaction, (2) assist in the determination of the fair value of any security or investment, or (3) provide legal, tax, or transactional advisory services.

All investment opportunities on SE BB are based on indicated interest from sellers and will need to be confirmed.

Investing in private company securities is not suitable for all investors. An investment in private company securities is highly speculative and involves a high degree of risk. It should only be considered a long-term investment. You must be prepared to withstand a total loss of your investment. Private company securities are also highly illiquid, and there is no guarantee that a market will develop for such securities. Each investment also carries its own specific risks, and you should complete your own independent due diligence regarding the investment. This includes obtaining additional information about the company, opinions, financial projections, and legal or other investment advice. Accordingly, investing in private company securities is appropriate only for those investors who can tolerate a high degree of risk and do not require a liquid investment.